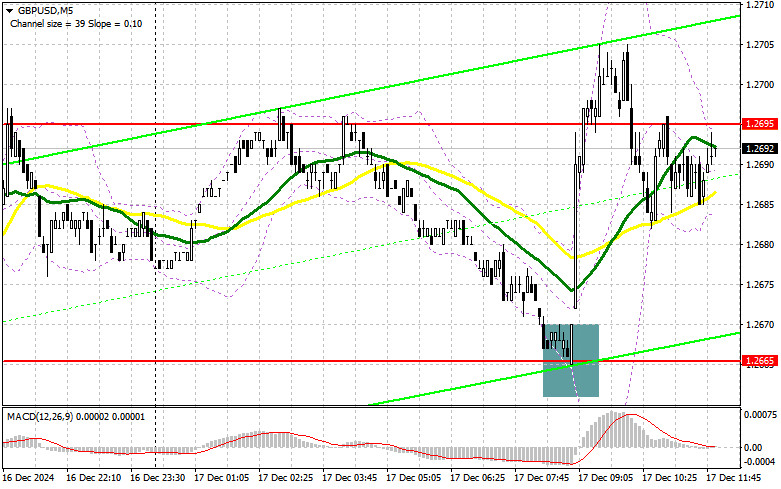

In my morning forecast, I paid attention to the level of 1.2665 and planned to make trading decisions from there. Let's look at the 5-minute chart and analyze what happened. A decline and the formation of a false breakout near 1.2665 provided an excellent entry point for buying the pound, resulting in a 30-point increase in the pair. The technical picture has been revised for the second half of the day.

To Open Long Positions on GBP/USD:

Data on the near absence of unemployment claims in the UK for November, along with a sharp increase in average earnings, supported the British pound, leading to GBP/USD strengthening and updating the daily high. However, buyers' momentum faded after this move.

In the second half of the day, significant US economic data will be released, including:

- Retail Sales for November (directly influencing inflation and the Fed's decisions).

- Industrial Production and Manufacturing Production.

If strong US data emerges, pressure on the pound will return. Therefore, I will act near 1.2667, as I did in the first half of the day.

- A false breakout at this level will provide a good buying point, aiming for a rebound to 1.2703 resistance.

- A break and retest of this range from above will create a new long entry point, with the prospect of updating 1.2733, where buyers are likely to face challenges.

- The final target will be 1.2761, where I plan to take profits.

If GBP/USD declines and buyers show no activity around 1.2667, they will lose initiative. In this case, a false breakout near the next support at 1.2639 will be a suitable condition for opening long positions. I will open long positions immediately on a rebound from 1.2612, targeting a 30-35 point upward correction within the day.

To Open Short Positions on GBP/USD:

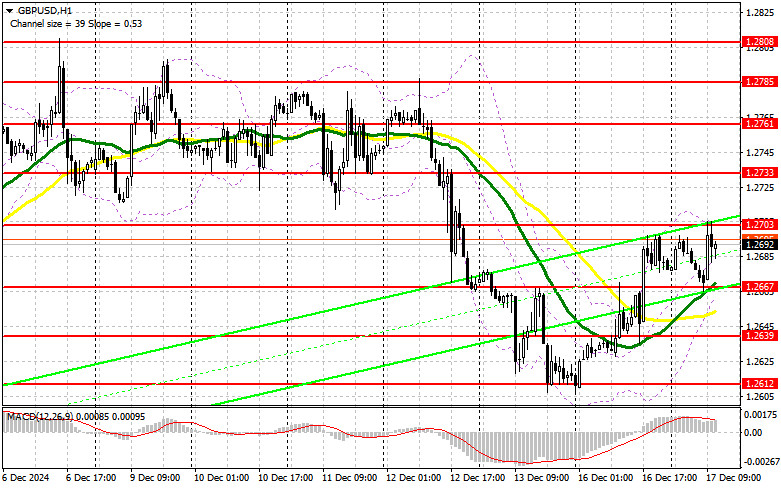

If the pound rises following weak US data and continues the morning's upward trend, defending resistance at 1.2703 will be the priority for sellers.

- A false breakout there will provide an entry point for short positions, targeting 1.2667, which already worked earlier today.

- The moving averages also pass through this level, supporting the bulls.

- A break and retest of this range from below will trigger stop orders and pave the way for 1.2639, delivering a significant blow to buyers.

- The final target will be 1.2612, where I will take profits.

If demand for the pound returns in the second half of the day after weak US data and sellers show no activity around 1.2703, buyers will gain a solid chance for another upward wave. In this case, bears will have no choice but to retreat to 1.2733 resistance.

- I will sell there only on a false breakout.

- If there is no downward move at this level, I will look for short positions on a rebound from 1.2761, targeting a 30-35 point downward correction.

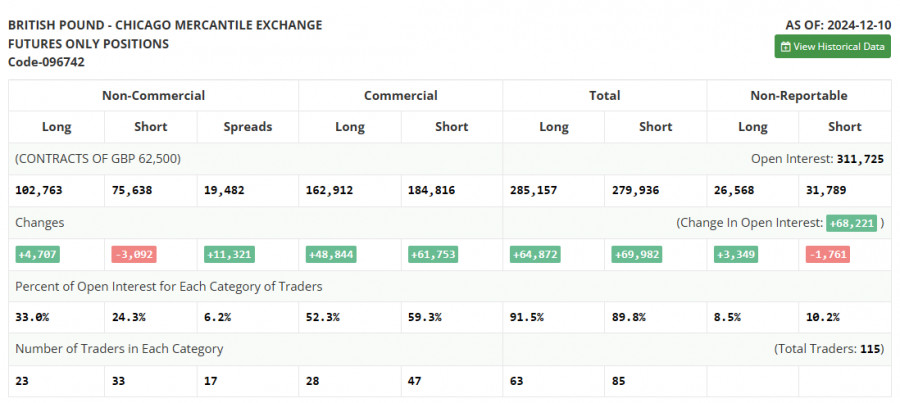

COT Report Analysis:

The COT report for December 10 indicated a reduction in short positions and a rise in long positions. Overall, nothing changed in the market balance, as many traders adopted a wait-and-see approach ahead of the Bank of England's final meeting of the year.

- Long non-commercial positions grew by 4,707 to 102,763.

- Short non-commercial positions decreased by 3,092 to 75,638.

- As a result, the spread between long and short positions widened by 11,321.

The Bank of England's decision on interest rates remains uncertain, particularly with the latest GDP and inflation data complicating its position. This has led to cautious trading behavior.

Indicator Signals:

Moving Averages:

Trading is occurring near the 30- and 50-day moving averages, indicating market uncertainty.

Note: The author uses the H1 chart for moving averages, which may differ from classic definitions on the D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator near 1.2665 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths volatility to identify trends. 50-period (yellow) and 30-period (green) lines.

- MACD (Moving Average Convergence/Divergence): Fast EMA (12), Slow EMA (26), Signal SMA (9).

- Bollinger Bands: Measures price volatility. Period: 20.

- Non-commercial Traders: Speculative traders (e.g., hedge funds) using futures for speculation.

- Long Non-commercial Positions: Total long open positions held by non-commercial traders.

- Short Non-commercial Positions: Total short open positions held by non-commercial traders.

- Net Non-commercial Position: Difference between short and long positions.