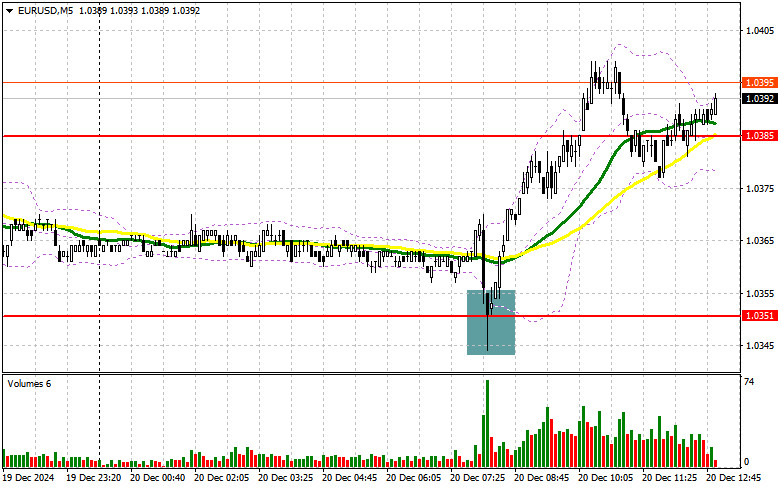

In my morning forecast, I highlighted the 1.0351 level and planned to base entry decisions on it. Reviewing the 5-minute chart, a decline followed by a false breakout near 1.0351 provided a good buying opportunity for the euro, resulting in a 30-point rise for the pair. The technical outlook has been adjusted for the second half of the day.

To Open Long Positions on EUR/USD:

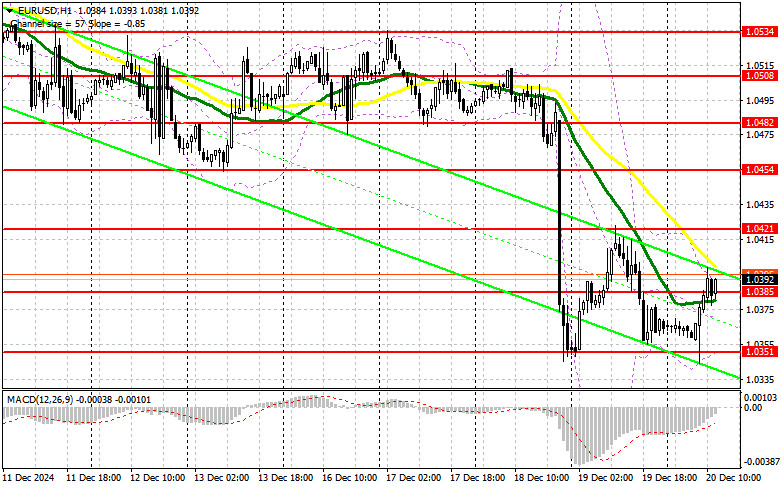

The U.S. session will bring key data on the Core Personal Consumption Expenditures Index (PCE), changes in consumer income and spending, which will be pivotal in determining today's market direction. Strong data could renew demand for the U.S. dollar, potentially harming the bullish prospects for the euro observed earlier in the day. In the case of strong statistics and a decline in the pair, only a false breakout near 1.0385—support formed during today's session—will provide a suitable condition for building long positions, aiming for a return to 1.0421. A breakout and retest of this range will confirm the correct buying point, with a target at 1.0454. The ultimate target will be the 1.0482 high, where profits will be taken.

If EUR/USD declines and no activity is observed near 1.0385 (which acts as the midpoint of the sideways channel), selling pressure will increase, leading to a steeper drop in the euro. In this case, I will consider buying only after a false breakout near the weekly low at 1.0351. I plan to open long positions on a rebound from 1.0308, targeting a 30-35 point intraday upward correction.

To Open Short Positions on EUR/USD

If the euro rises on weak U.S. data, protecting the 1.0421 resistance will be the priority for sellers. A false breakout at this level will revive bearish momentum and provide a selling opportunity, targeting support at 1.0385, where trading is currently centered, along with the moving averages. A breakout and consolidation below this range, followed by a retest from below, will offer another selling opportunity, aiming for the 1.0351 low, which would undermine buyers' plans for further correction. The ultimate target will be the 1.0308 level, where profits will be taken.

If EUR/USD moves higher in the second half of the day and bears fail to act near 1.0421, I will postpone selling until the next resistance at 1.0454 is tested. Selling will be considered there only after a failed consolidation. I plan to open short positions on a rebound from 1.0482, targeting a 30-35 point downward correction.

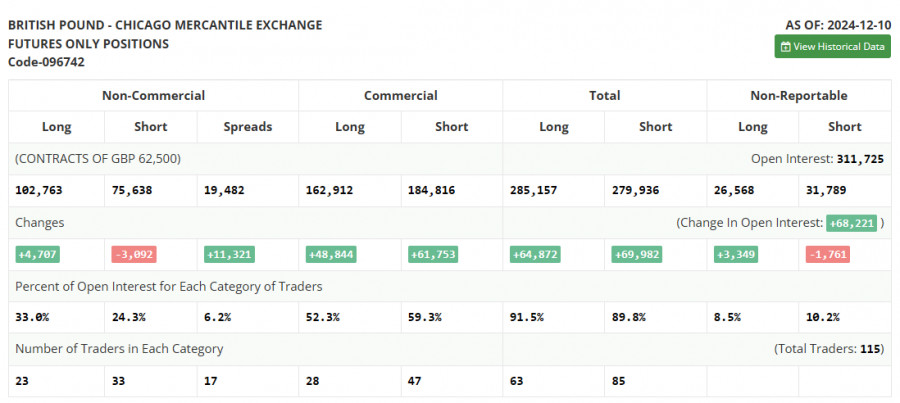

Commitments of Traders (COT) Report

The COT report for December 10 showed an increase in short positions and a reduction in long positions. Overall, the new figures indicate little change in market positioning. The upcoming final meeting of the Federal Reserve this year will likely result in a rate cut, which has recently limited the dollar's growth while maintaining demand for risk assets. A more cautious approach by the Fed next year could significantly increase the chances of a bearish market return for EUR/USD. The report showed that long non-commercial positions fell by 10,318 to 157,375, while short non-commercial positions rose by 7,766 to 232,948. As a result, the gap between long and short positions widened by 4,450.

Indicator Signals

Moving AveragesTrading is occurring around the 30 and 50-day moving averages, indicating a sideways market.

Note: The moving averages' period and prices are based on the hourly (H1) chart, differing from the classical daily averages on the daily (D1) chart.

Bollinger BandsIn case of a decline, the lower boundary of the indicator near 1.0351 will serve as support.

Indicator Descriptions

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period: 50 (yellow on the chart), 30 (green on the chart).

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12, Slow EMA – 26, SMA – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using futures markets for speculative purposes.

- Long non-commercial positions: The total long open position of non-commercial traders.

- Short non-commercial positions: The total short open position of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.