The US stock market has significantly adjusted today after the week's start in the red zone. It seems that many investors, despite statements by representatives of the Federal Reserve System that it is necessary to adhere to a hawkish policy on interest rates, still bet that Powell will slow down. At least he will not continue to say so fiercely that he does not care about the economy as long as inflation returns to normal. Any dovish reversal, even if there is hope for it, will signal bulls to buy risky assets.

Statements about when the Fed will "tie up" with an increase in rates and start a cycle of lowering them are also important. Initially, it was said that by the summer of next year, rates would begin to be lowered. If this turns out not to be the case – additional pressure on buyers and the stock market further down to annual lows, although we are unlikely to reach them. Esther George, head of the Kansas City Fed, said that the committee has not yet raised interest rates to those levels that will negatively affect the economy and may have to step over even the level above 4% for some time. "It is very important that we communicate where we are going." His colleague in the role, Atlanta Fed President Rafael Bostic, said he had not yet decided whether to support a 50 or 75 basis point increase at the September 20-21 meeting. "We all, as politicians, understand that inflation is a big problem, and we will do everything possible to cope with it."

Meanwhile, crude oil gained a foothold at $93 per barrel, gold fluctuated in the channel, and bitcoin fell to $21,000. The MSCI Inc. stock index in the Asia-Pacific region rose to a one-week high.

Premarket

Gap shares rose 6% in premarket trading after the clothing retailer reported a surprise quarterly profit. This is quite surprising, especially against the background of a serious inflationary jump. The company reported that the growth was facilitated by a jump in sales of more elegant clothes in the Banana Republic network.

Affirm Holdings' securities fell 13.5% in premarket trading after larger-than-expected quarterly losses and a weaker-than-expected forecast.

Everbridge shares jumped 14.3% in premarket trading on news that the enterprise software company is exploring strategic options, including a possible sale.

The well-known Dell company fell 5.5% in the premarket after quarterly revenue was below analysts' estimates. Everyone is to blame for the decline in sales after the PC sales boom in the pandemic era.

Shares of Farfetch rose 14.1% in premarket trading after the online luxury goods retailer reported smaller-than-expected quarterly losses and earnings.

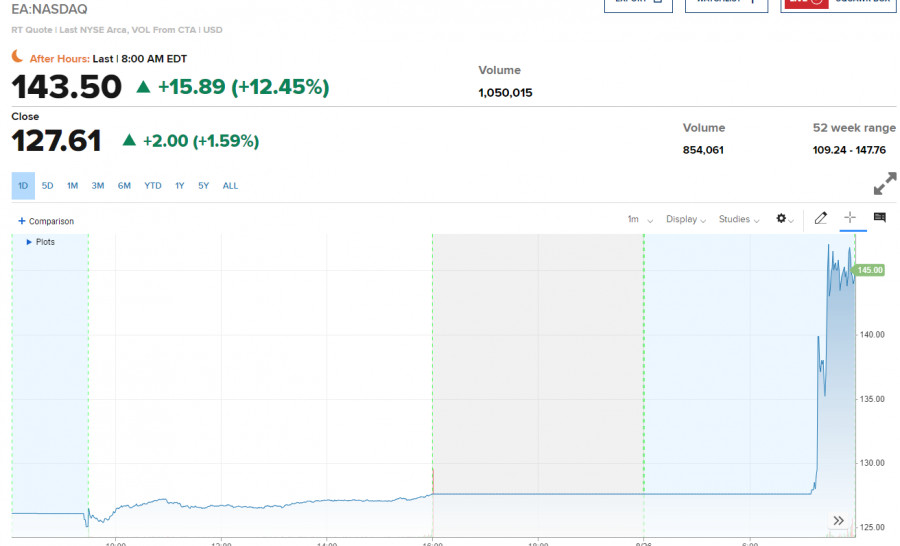

The main news for today is Amazon's statement that it has made an official offer to acquire Electronic Arts (EA). Rumors of a potential EA buyout have been circulating online for several weeks, with Apple, Disney, and Amazon listed as potential buyers. The proposed amount has not yet been disclosed, but rumors are that a new record will be set. Against this background, Electronic Arts shares have already grown by 16.0%.

Let me remind you that the last unprecedented acquisition in the field of video games was Microsoft's purchase of Activision Blizzard for $ 69 billion.

According to the S&P500, the bulls managed to defend the $4,150 level yesterday and got above $4,184, but they failed to stay there. I advise you to pay attention to this level since the continuation of the growth of the trading instrument depends on its breakdown. In the case of a downward movement after Powell's statements and weak statistics on the US economy, a breakdown of $4,150 will open a direct road to the area of $4,116 and $4,090, where the pressure on the trading instrument may ease slightly. The index will also approach fairly important support levels, breaking below, which will not be easy – provided that there are real buyers in the market. The index will be able to talk about further growth only after controlling the resistance of $ 4,184, the test of which has already taken place today. This will bring the total to $4,208. Only in this way will we see fairly active growth in the area of $4,229, where large sellers will return to the market again. At a minimum, there will be those who want to lock in profits on long positions. A more distant target will be the $4,255 level.