Analysis of Trades and Trading Advice for the Euro

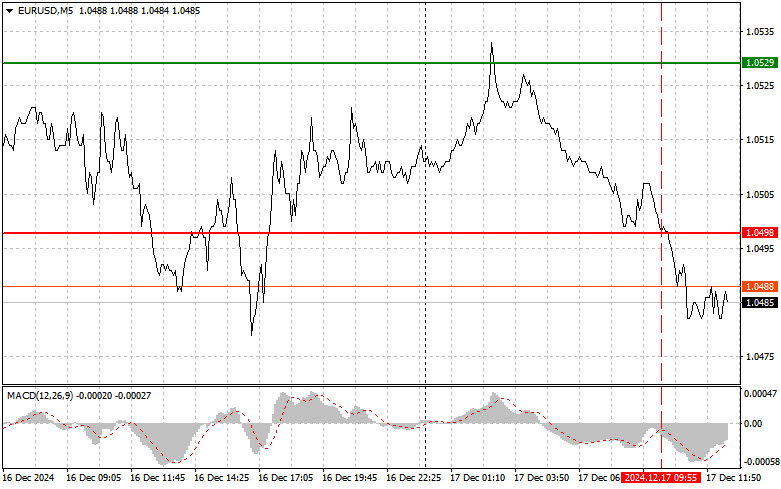

The test of the 1.0498 price occurred when the MACD indicator had already moved far below the zero mark, which, in my opinion, limited the pair's downward potential. For this reason, I did not sell the euro. I did not get any other entry points.

Recent data from IFO indicates that Germany's economic outlook, as a key player in Europe, continues to weaken by the day. A decline in the business activity index could lead to reduced consumer spending and a slowdown in industrial production. This, in turn, creates additional uncertainty regarding the monetary policy of the European Central Bank (ECB), which is already forced to lower interest rates against its initial plans to sustain regional economic growth. The latest IFO data highlights the need for a closer analysis of current economic trends and their impact on currency exchange rates.

In the second half of the day, key US economic data will be published, including:

- Changes in retail sales volume.

- Changes in industrial production volume for November.

These indicators serve as vital barometers of economic health and consumer activity. A decline in these figures could signal a slowdown in economic growth, potentially weakening the US dollar. Considering the current economic environment, where inflation continues to pressure households, it is becoming increasingly likely that after tomorrow's interest rate cut, the Federal Reserve will pause at the start of next year.

The Capacity Utilization Rate is another important indicator. An increase in this figure suggests that companies are utilizing their capacities more efficiently, laying the groundwork for increased investment flows and a potential rise in the dollar's value.

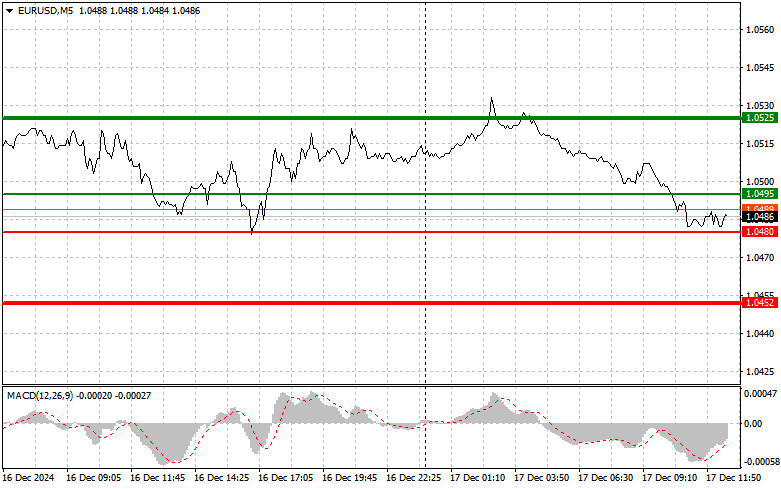

For the intraday strategy, I will focus on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1:

Buy the euro when the price reaches 1.0495 (green line on the chart). Target: Growth to 1.0525. At 1.0525, I plan to exit the market and sell the euro in the opposite direction, expecting a move of 30-35 points from the entry point. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2:

I also plan to buy the euro if there are two consecutive tests of the 1.0480 level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. Expect growth to the opposite levels of 1.0495 and 1.0525.

Sell Signal

Scenario #1:

I plan to sell the euro after reaching the 1.0480 level (red line on the chart). Target: 1.0452, where I plan to exit the market and immediately buy in the opposite direction, expecting a move of 20-25 points upward. Selling pressure will return in case of strong US retail sales data. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2:

I will also sell the euro if there are two consecutive tests of the 1.0495 level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. Expect a decline to the opposite levels of 1.0480 and 1.0452.

Chart Notes:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Expected price for placing Take Profit or manually fixing profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Expected price for placing Take Profit or manually fixing profits, as further decline below this level is unlikely.

- MACD Indicator: Use overbought and oversold zones as guides for market entry.

Important:

Beginner traders on the Forex market must make cautious decisions when entering the market. Before the release of major fundamental reports, it is best to stay out of the market to avoid being caught by sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

Remember: Successful trading requires a clear trading plan, like the one I presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.