Analysis of Tuesday's Trades

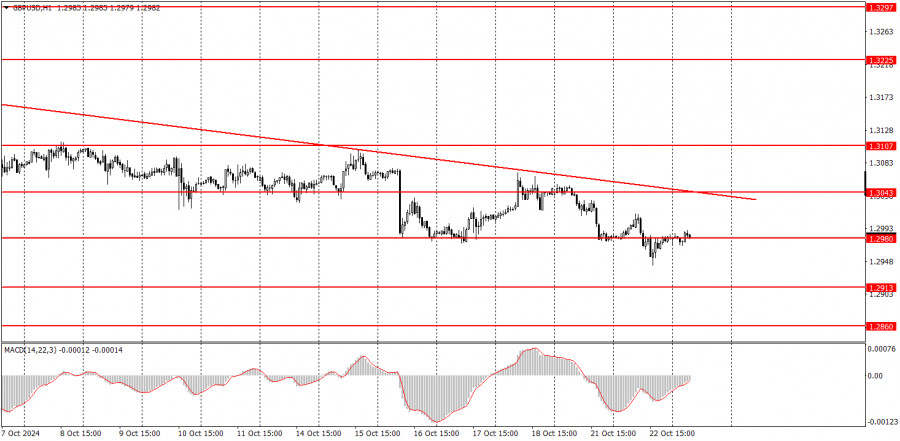

1H Chart of the GBP/USD Pair

On Tuesday, the GBP/USD pair continued its decline, even though there were no local reasons for this. Yesterday, there were no events or reports related to the dollar or the pound. Yet, even under these circumstances, the British pound leaned toward a decline. We have a clear downward trend and a trend line, with the pound falling almost daily. We believe there's no need to reinvent the wheel and look for buying signals. The British pound could continue declining for several weeks, even without a correction. Considering how much and quickly it had risen, such a development wouldn't surprise us. Since the market has wholly or almost entirely priced in the Federal Reserve's monetary policy easing, attention is shifting to the Bank of England. It has only lowered the rate once, suggesting that the pace of cuts will accelerate soon. This is a reasonable basis for the pound's continued decline.

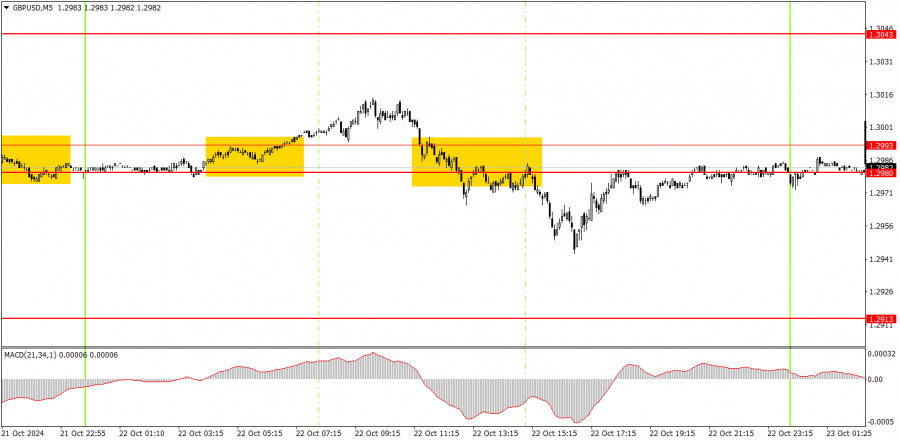

5M Chart of the GBP/USD Pair

On Tuesday's 5-minute timeframe, two trading signals were formed near the 1.2980-1.2993 area. In both cases, the movement in the intended direction did not continue long enough to yield a significant profit. However, buy signals are not a priority right now, and after the sell signal, the price decreased by about 25 pips.

How to Trade on Wednesday:

In the hourly time frame, the GBP/USD pair broke the upward trend and continued to decline. We fully support the pair's decline in the medium-term perspective, as we believe this is the only logical scenario. The British pound may attempt a correction soon, but it would need to consolidate above the trend line for this to be evident. In any case, volatility is currently low, so a strong and rapid rise is unlikely.

The pair may sustain its downward movement on Wednesday, as the trend line has not been breached. As long as the price remains below the trend line, discussing buying is pointless. Even in that case, it would only be a correction.

In the 5-minute time frame, trading can currently be based on the levels of 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, 1.3102-1.3107, 1.3145-1.3167, 1.3225, 1.3272, 1.3365, 1.3428-1.3440. On Wednesday, no significant events are again scheduled in the UK or the US. As a result, volatility may remain low, but at this time, traders have enough technical benchmarks to trade based solely on them.

Basic Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form (bounce or break through a level). The less time it takes, the stronger the signal.

- If two or more trades were opened with false signals around a certain level, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate many false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

- Trading should be done between the start of the European session and the middle of the American session, after which all trades should be closed manually.

- On the hourly time frame, trade signals from the MACD indicator are best used when there is good volatility and a trend confirmed by a trendline or channel.

- If two levels are too close to each other (5 to 20 pips apart), consider them as a support or resistance zone.

- When the price moves 20 pips in the intended direction, set a Stop Loss to break even.

What's on the Charts:

Support and Resistance Price Levels: These levels serve as targets when opening buy or sell positions. They can also be used as points to set Take Profit levels.

Red Lines: These represent channels or trend lines that display the current trend and indicate the preferred trading direction.

MACD Indicator (14,22,3): The histogram and signal line serve as a supplementary indicator that can also be used as a source of trading signals.

Important Speeches and Reports (always found in the news calendar) can significantly impact the movement of a currency pair. Therefore, trading should be done with maximum caution during their release, or you may choose to exit the market to avoid a sharp price reversal against the preceding movement.

For Beginners Trading on the Forex Market: It's essential to remember that not every trade will be profitable. Developing a clear strategy and practicing money management is key to achieving long-term success in trading.